The Basic Principles Of Property By Helander Llc

Wiki Article

More About Property By Helander Llc

Table of ContentsThe Only Guide for Property By Helander LlcThe 5-Minute Rule for Property By Helander LlcThe Best Strategy To Use For Property By Helander LlcThe Main Principles Of Property By Helander Llc The Best Guide To Property By Helander LlcThe Buzz on Property By Helander Llc

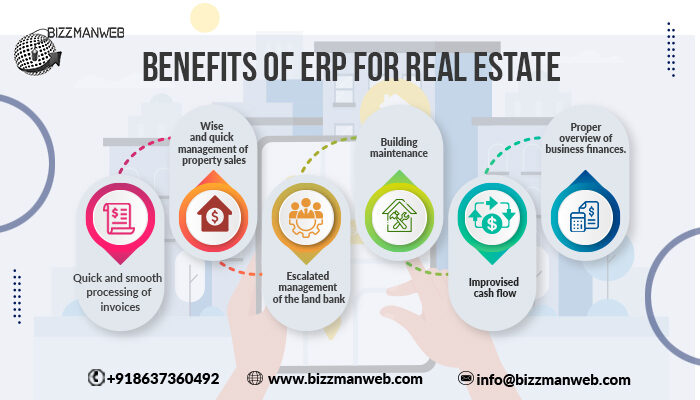

The benefits of spending in actual estate are countless. Below's what you need to understand regarding actual estate advantages and why real estate is thought about an excellent financial investment.The benefits of investing in actual estate consist of passive revenue, secure cash money circulation, tax advantages, diversity, and take advantage of. Actual estate investment company (REITs) supply a means to buy property without needing to own, run, or finance buildings - https://www.openstreetmap.org/user/pbhelanderllc. Capital is the take-home pay from a property investment after home loan payments and operating budget have been made.

In numerous instances, cash circulation just strengthens gradually as you pay down your mortgageand accumulate your equity. Investor can make use of countless tax obligation breaks and deductions that can conserve money at tax time. Generally, you can subtract the affordable costs of owning, operating, and handling a building.

9 Easy Facts About Property By Helander Llc Explained

Genuine estate values have a tendency to increase over time, and with a good investment, you can transform a profit when it's time to offer. As you pay down a property home loan, you build equityan possession that's component of your internet worth. And as you construct equity, you have the take advantage of to buy even more homes and raise cash money circulation and wide range also more.

Since realty is a concrete possession and one that can act as security, funding is conveniently offered. Actual estate returns vary, relying on variables such as area, possession class, and administration. Still, a number that many financiers intend for is to beat the average returns of the S&P 500what lots of people refer to when they state, "the market." The rising cost of living hedging ability of realty originates from the positive connection between GDP growth and the demand genuine estate.

Property By Helander Llc Fundamentals Explained

This, subsequently, translates right into higher capital worths. Actual estate has a tendency to maintain the acquiring power of funding by passing some of the inflationary pressure on to tenants and by incorporating some of the inflationary pressure in the type of capital appreciation. Home loan loaning discrimination is unlawful. If you believe you have actually been victimized based on race, faith, sex, marriage condition, use public support, nationwide beginning, disability, or age, there are actions you can take.Indirect property investing includes no straight ownership of a residential or commercial property or residential properties. Instead, you purchase a swimming pool along with others, wherein a management company has and operates residential properties, or else owns a portfolio of mortgages. There are numerous ways that possessing property can secure versus rising cost of living. Property worths may climb greater than the price of rising cost of living, leading to capital gains.

Homes funded with a fixed-rate car loan will certainly see the loved one amount of the monthly mortgage settlements fall over time-- for instance $1,000 a month as a fixed payment will certainly end up being go to my blog less challenging as rising cost of living wears down the acquiring power of that $1,000. https://pbhelanderllc.weebly.com/. Often, a key home is not thought about to be a property investment since it is used as one's home

The Ultimate Guide To Property By Helander Llc

Also with the assistance of a broker, it can take a few weeks of work just to discover the right counterparty. Still, realty is a distinct property course that's simple to understand and can boost the risk-and-return account of an investor's profile. On its very own, realty supplies capital, tax breaks, equity structure, affordable risk-adjusted returns, and a hedge versus inflation.

Buying realty can be an extremely fulfilling and rewarding endeavor, however if you resemble a lot of brand-new financiers, you may be questioning WHY you must be purchasing property and what benefits it brings over other financial investment opportunities. Along with all the amazing benefits that occur with purchasing property, there are some drawbacks you require to consider too.

Not known Details About Property By Helander Llc

At BuyProperly, we use a fractional ownership version that permits financiers to begin with as little as $2500. Another major benefit of real estate investing is the capacity to make a high return from buying, remodeling, and marketing (a.k.a.Most flippers look for undervalued buildings in great neighborhoodsExcellent The fantastic point about investing in genuine estate is that the worth of the property is expected to value.

Property By Helander Llc - Truths

As an example, if you are charging $2,000 lease each month and you incurred $1,500 in tax-deductible costs per month, you will only be paying tax obligation on that $500 profit each month. That's a huge distinction from paying tax obligations on $2,000 each month. The earnings that you make on your rental system for the year is thought about rental income and will be strained appropriatelyReport this wiki page